2025 Medicare Changes

The 2025 Medicare changes will mainly impact Medicare Part C (Medicare Advantage) and Part D (Prescription Drug) plans and optional plan enrollment timeframes for those qualifying for the low-income subsidy.

Medicare Advantage (Part C)

The 2025 Medicare changes require Medicare Advantage (Part C) plans to send policyholders a mid-year notification detailing unused supplemental benefits, such as dental or vision coverage, to encourage better utilization.

Medicare Advantage (Part C) plans often offer coverage that traditional Medicare doesn’t, such as routine dental, vision and hearing, fitness benefits, grocery cards, and pre-loaded debit cards for over-the-counter items. These “supplemental” benefits are included with specific plans and marketed heavily to encourage someone to enroll.

The notification will list all supplemental benefits the enrollee hasn’t used, the scope and out-of-pocket cost for claiming each benefit, instructions on accessing the benefits, and a customer service number to call for more information. My clients know to contact me any time during the year with questions or concerns about their Medicare plan. 🙂

According to a study by The Commonwealth Fund, three in ten beneficiaries in Medicare Advantage plans said they did not use any of their plan’s supplemental benefits in the past year. The study also found evidence that Medicare Advantage plans were more likely to burden patients with needing prior approvals, so check plan requirements carefully! We can help you review the plans in your area!

What is a Medicare Advantage (Part C) plan?

A Medicare Advantage (Part C) plan is an alternative way to receive Medicare benefits through private insurance companies approved by Medicare, such as Aetna, Humana, and United Health.

Plans must cover all the services that Original Medicare (Part A and Part B) covers. Still, as stated above, they often include additional “supplemental” benefits not offered by Original Medicare and Medicare Part D prescription coverage.

Medicare Advantage plans can be appealing due to their bundled coverage and additional benefits. Still, they may also have more restrictions regarding provider networks and require prior authorizations for specific services.

The 2025 Medicare changes will affect most if not all, Medicare Advantage (Part C) plans, so contact your trusted agent or our office to ensure you understand your options! Please call or text (404) 996-0045 and schedule a call with me to review your plan options in your area.

Medicare Prescription Drug Coverage (Part D)

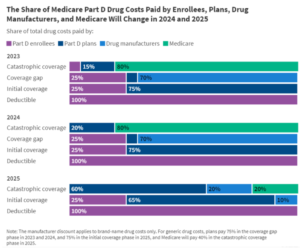

The 2025 Medicare changes for Part D drug plans include a $2,000 annual cap on out-of-pocket drug costs. Once enrollees hit this cap, they will not have to pay any more out-of-pocket for their medications for the rest of the year. This change, part of the Inflation Reduction Act, is expected to provide considerable financial relief to those with high drug costs.

The 2025 Medicare changes for Part D drug plans include a $2,000 annual cap on out-of-pocket drug costs. Once enrollees hit this cap, they will not have to pay any more out-of-pocket for their medications for the rest of the year. This change, part of the Inflation Reduction Act, is expected to provide considerable financial relief to those with high drug costs.

The coverage gap phase (often called the “donut hole”) will be eliminated in 2025.

This means that Part D enrollees will no longer face a change in their cost-sharing for a given drug when they move from the initial coverage phase to the coverage gap phase, which is the case in most Part D plans as of 2024. Most plans charge varying cost-sharing amounts rather than the standard 25% coinsurance in the initial coverage phase, which can create more confusion for the enrollee while using the plan.

Additionally, Part D enrollees can spread out their out-of-pocket costs over the year rather than face high out-of-pocket costs in any given month.

This new rule applies only to medications covered by your Part D plan and does not apply to out-of-pocket spending on Medicare Part B drugs. Part B drugs are usually vaccinations, injections a doctor administers, and some outpatient prescription drugs.

What is a Medicare Prescription (Part D) plan?

A Medicare Prescription Drug Plan (Part D) is a type of insurance that helps cover the cost of prescription medications. Private insurance companies approved by Medicare offer these plans. They can be added to your Original Medicare (Part A and Part B) or certain Medicare Advantage (Part C) plans that don’t already include drug coverage.

Medicare Part D is crucial for managing prescription drug costs, especially as out-of-pocket expenses can be high without it.

The 2025 Medicare changes will affect Part D plans, so contact your trusted agent or our office to ensure you understand your options.

Enrollment Changes for Low-Income Medicare Beneficiaries

For dual-eligible beneficiaries (those who qualify for both Medicare and Medicaid) and those receiving Extra Help (help with prescription drug costs), a Special Enrollment Period will be offered monthly instead of quarterly, providing more flexibility in switching plans.

If this is you, there is no reason to change your plan each month, even quarterly. Find a trustworthy agent, and they’ll guide you on the right coverage from the start so you’re confident in your plan for the following year.

Conclusion on 2025 Medicare Changes

With Medicare, if one thing is constant, it changes! Depending on your situation, these changes may be good or bad. These changes aim to reduce out-of-pocket expenses, improve access to benefits, and enhance plan transparency and flexibility for all Medicare beneficiaries.

Medicare is confusing. If you have questions about your Medicare coverage and want to review Medicare plans in your area, please call or text (404) 996-0045. (Toll-Free: 888- 901-4870)