- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

When Does Medicare Coverage Start?

May 17, 2023

Medicare Supplement Questions?

December 8, 2023Determining the best Medicare plan for you depends on your specific needs and circumstances. Medicare offers several plans, so it’s essential to consider factors such as your health conditions, preferred healthcare providers, budget, and prescription medication needs.

Here’s a general overview of the different Medicare plan options:

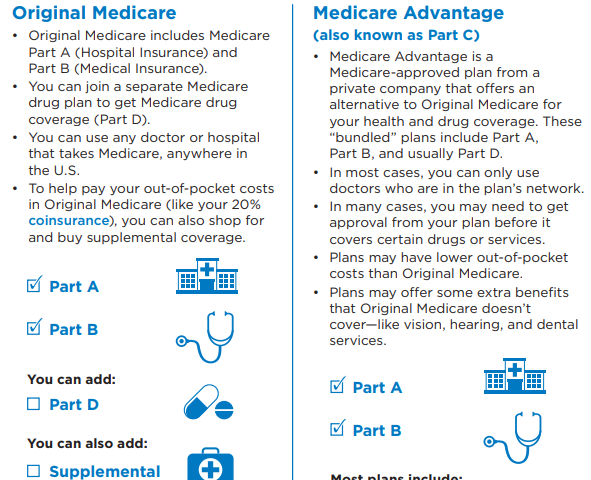

- Original Medicare (Parts A and B): Original Medicare is provided by the federal government and includes 80% hospital insurance (Part A) and 80% medical insurance (Part B). It covers a portion of your healthcare costs, but you’ll typically have deductibles, copayments, and coinsurance to pay.

- Medicare Advantage (Part C): Medicare Advantage plans are offered by private insurance companies approved by Medicare. They provide all the benefits of Original Medicare (Parts A and B) and often include additional coverage, such as prescription drugs (Part D), vision, dental, and hearing. Medicare Advantage plans typically have network restrictions, so you must choose from a list of approved providers.

- Prescription Drug Coverage (Part D): Part D is prescription drug coverage that can be added to Original Medicare or a Medicare Advantage plan. It helps with the cost of prescription medications and is offered through private insurance companies.

- Medigap (Medicare Supplement Insurance): Medigap plans, also known as Medicare Supplement plans, are offered by private insurance companies to help cover the “gaps” in Original Medicare. They can help pay for deductibles, copayments, and coinsurance. Medigap plans work alongside Original Medicare and typically don’t cover prescription drugs.

How to choose the best Medicare plan for you, consider the following steps:

- Assess your healthcare needs: Consider your current health conditions, medications you take, and any anticipated medical procedures or treatments you may need in the future.

- Evaluate your preferred providers and healthcare facilities: Check if your preferred doctors, hospitals, and specialists are in-network for the plans you’re considering.

- Review the costs: Compare the premiums, deductibles, copayments, and coinsurance for each plan. Consider your budget and how much you’re willing to pay for coverage.

- Consider additional benefits: If you have specific needs like dental, vision, or hearing coverage, check if those services are included in the plans you’re evaluating.

- Research plan ratings and reviews: Look for plan ratings and reviews to understand different Medicare plans’ quality and satisfaction levels.

- Seek assistance: Reach out to a Medicare independent insurance broker (like me, shameless plug!) who can provide personalized guidance based on your circumstances.

It’s important to carefully evaluate your options and choose the best Medicare plan that aligns with your healthcare needs and financial situation.

We can help!

Next Steps

Please visit the Contact Us page to request an appointment, or you can call (888) 901-4870!

Chad Cason

Agency Owner/Licensed Agent

Lifelong Insurance Agency

Lifelong Insurance

I’m Chad Cason, owner of Lifelong Insurance, LLC, and I specialize in helping people with their Medicare, Medigap and Medicare Advantage decisions. As an independent health and life insurance broker, I’m not tied to any one carrier. Instead, I’m free to walk you through any of the major reputable carriers in your area and help you make the right decision for your individual circumstances.