- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

2023 Medicare Costs

October 22, 2022

When Does Medicare Coverage Start?

May 17, 2023Compare Medicare Supplement Plan G versus Plan N

Medicare Supplement (Medigap) insurance plans help pay deductibles and coinsurance Medicare doesn’t cover. In this article, we’ll compare Medicare Supplement Plan G versus Plan N.

Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan.

- Must offer Medigap Plan A (different than Medicare Part A, which provides your 80% Hospital) if they offer any Medigap policy.

- Must also offer Plan C (different than Part C, which is also known as Medicare Advantage) or Plan F if they offer any plan.

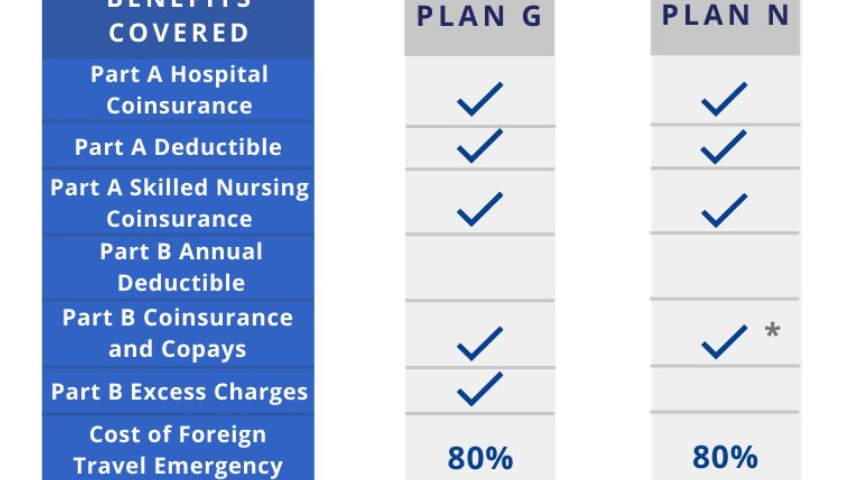

Compare Medicare Supplement Plan G versus Plan N

Plan G and Plan N pay 100% of the Medicare Part A (Hospital 80%) deductible and 20% co-insurance. This provides you with 100% hospital coverage with Medicare.

For Part B (Medical 80%) expenses, such as a doctor, specialist, outpatient, diagnostics, labs, etc., you’re responsible for the Medicare Part B calendar-year deductible ($226 for 2023) before Medicare and your Medicare Supplement plan pay.

With Plan G, once you’ve met the Part B deductible, you have nothing else out of pocket for any Part B services or procedures for the year.

With Plan N, in addition to the Part B deductible, you may incur up to a $20 copay per doctor visit and a $50 copay for ER (waived if admitted to the hospital). Plan G has no copays.

Lastly, Plan N doesn’t cover Part B, “Excess Charges,” and Plan G does. Let me explain. (There are no excess charges under Part A Hospital.)

Excess Charges and Medicare Assignment

Although Plan N doesn’t pay a benefit for excess charges, most Medicare Supplement claims don’t include excess charges. So even Plan N policyholders generally don’t pay for excess charges.

Here’s why:

Ninety-six percent of U.S. healthcare providers that work with Medicare accept Medicare assignment. This means there aren’t any excess charges.

The provider has agreed to accept the Medicare-approved amount as full payment so that excess charges won’t be passed on to patients.

In the unlikely event that your provider or supplier doesn’t accept Medicare assignment, they’re called “non-participating.”

Here’s what you can expect:

- You may have to pay the entire charge at the time of service.

- Non-participating providers can charge more than the Medicare-approved amount, but there’s a limiting charge. This means the provider can charge up to 15% over the amount non-participating providers are paid, about 95% of the fee schedule amount.

- The limiting charge only applies to certain Medicare-covered services, not some supplies and durable medical equipment.

What You Can Do

Ask any regular doctors or providers you see if they accept Medicare assignment. If so, they likely won’t have out-of-pocket costs for Part B excess charges.

Plan N premiums are about $25-30 less monthly than Plan G, depending on your state.

I think you’ll be happy with either Plan G or Plan N. I recommend going with the plan that makes the most sense for you.

If you want to discuss your Medicare coverage and get rates, please call or click the link below.

Medicare eligible and still working? Learn more about your options here >> Turning 65 and Still Working?

What is Medicare Advantage “Part C?” Click here to learn more >> Medicare Advantage “Part C”

Chad Cason

Licensed Independent Medicare Plan Agency/Agent

(404) 996-0045

(888) 901-4870

Schedule a call with Chad!

1 Comment

[…] Financial situations are unique, and medical coverage decisions are personal to every consumer. I believe those who appreciate the peace of mind of being able to best predict their total annual out-of-pocket costs may be driving the popularity of Plan G and other Medicare Supplement plans, like Plan N. […]