- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Life Insurance for Diabetics

July 16, 2014Life Insurance for Baby Boomers

December 23, 2014The Medicare Annual Enrollment is the best time for clients to shop around for new Medicare coverage — even if they are happy with their current plan — to see if it is still appropriate for their needs.

The annual enrollment period for Plan year 2015 begins Oct. 15th and runs through Dec. 7th of 2014- with coverage beginning on Jan. 1st, 2015. The technical term is Annual Election Period or AEP.

Most seniors believe this is the only time they can make a change to their Medicare coverage. That is true for the most part, unless you have a Medicare Supplement plan, also known as a Medigap plan.

The Annual Enrollment period is for people who are eligible for Medicare- who are enrolled in or want to enroll in a Medicare Advantage Plan or a Part D Prescription Drug Plan. If you’re currently enrolled in one of these plans, this is the time of year when you can join, switch or drop this type of coverage.

Only 19% of current Medicare beneficiaries say they actually understand their health care options, according to a recent Merrill Lynch study conducted by AgeWave on the convergence of health and retirement planning. By not understanding the benefits of your current plan and by not reviewing your Medicare and Medicare Supplemental options on a regular basis- it could cost you big.

During this annual enrollment period, Medicare Plans (Medicare Advantage plans) and Part D Drug plans release their new plans and benefits as well as pricing. So, if you’re enrolled in one of these plans, you may want to review your coverage each year.

The term ‘Medicare Plan’ usually refers to Medicare Advantage plans, not Medicare Supplements.

A Medicare Advantage Plan (like an HMO or PPO) is another way to get your Medicare coverage. If you join a Medicare Advantage Plan, you

still have Medicare. You’ll get your Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) coverage from the Medicare

Advantage Plan, not Original Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

Medicare Advantage Plans cover all Medicare services

In all types of Medicare Advantage Plans, you’re always covered for emergency and urgent care. Medicare Advantage Plans must cover all of the services that Original Medicare covers except hospice care and some care in qualifying clinical research studies. Original Medicare covers

hospice care and some costs for clinical research studies even if you’re in a Medicare Advantage Plan.

Medicare Advantage Plans may offer extra coverage, like vision, hearing, dental, and health and wellness programs. Most include Medicare

prescription drug coverage (Part D). In addition to your Part B premium, you may pay a monthly premium for the Medicare Advantage Plan.

Do you like low premiums and the all-in-one approach with your Medicare coverage? Then a Medicare Advantage plan may be better.

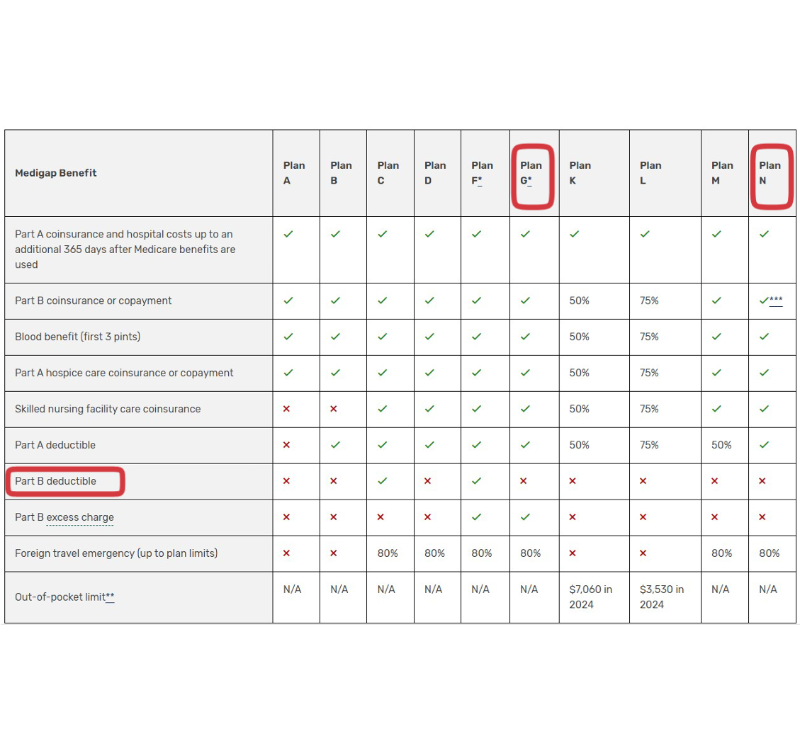

Do you like fixed costs and the freedom to choose your doctors? Maybe a Medicare Supplement is a better fit.

We can help you find the right coverage.