- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

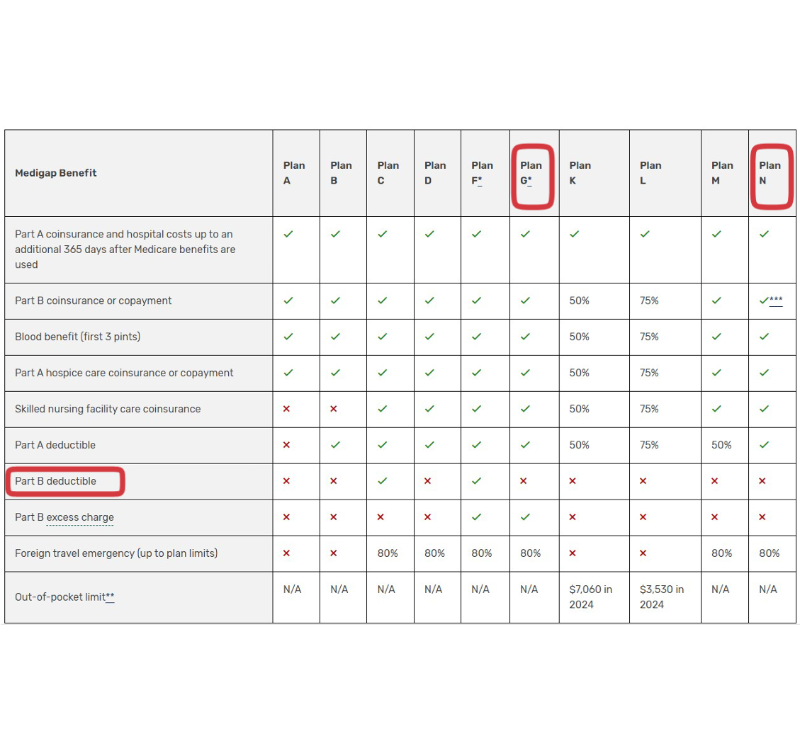

Medicare Supplement Plan G

June 20, 2024

2025 Medicare Changes

August 15, 2024Your Medicare Part B Premium

Original Medicare consists of Medicare Parts A and B. Part A provides 80% coverage for your inpatient hospital expenses, and most people have a $0 premium per month. Medicare Part B provides 80% coverage for outpatient care, doctor services, preventive services, and some home health services. Your Medicare Part B premium can vary based on several factors, including income. Here’s a breakdown of how it generally works:

Standard Medicare Part B Premium (most people pay this amount)

The Centers for Medicare & Medicaid Services (CMS) sets the standard Part B premium amount yearly for most beneficiaries. For 2024, the standard monthly premium is $174.70.

Three reasons your Medicare Part B Premium is more or less than expected

1. Income-Related Monthly Adjustment Amount (IRMAA)

If your income is above a certain threshold, you may have to pay an additional amount, known as the Income-Related Monthly Adjustment Amount (IRMAA). The thresholds and additional amounts are as follows:

- Individual income of $97,000 or less / Married, filing jointly income of $194,000 or less: $174.70 (standard premium)

- Individual income between $97,001 and $123,000 / Married, filing jointly income between $194,001 and $246,000: $243.70

- Individual income between $123,001 and $153,000 / Married, filing jointly income between $246,001 and $306,000: $316.20

- Individual income between $153,001 and $183,000 / Married, filing jointly income between $306,001 and $366,000: $388.70

- Individual income between $183,001 and $500,000 / Married, filing jointly income between $366,001 and $750,000: $461.30

- Individual income above $500,000 / Married, filing jointly income above $750,000: $540.30

2. Late Enrollment Penalty

If you do not sign up for Medicare Part B when you first become eligible and do not qualify for a Special Enrollment Period (SEP), you may have to pay a late enrollment penalty. The late enrollment penalty is an additional 10% of the standard Part B premium for every 12 months you could’ve had Part B but did not sign up. Penalties are added to your monthly Part B premium, and you will have to pay this penalty for as long as you have Medicare Part B coverage.

3. Low-Income

If you have a low income, you might qualify for programs that help pay your Medicare Part B premium, like the Medicare Savings Programs (MSPs), in which there are four levels you can qualify for, or as a “Dual-Eligibile” beneficiary, meaning you get Medicare and Medicaid.

Dual-Eligible Medicare plans, or Dual-Eligible Special Needs Plans (D-SNPs), are a type of Medicare Advantage (Part C) plan specifically designed for individuals who qualify for both Medicare and Medicaid. These plans provide an integrated approach to care, often offering additional benefits and services beyond what is typically covered by Medicare and Medicaid. Our agency can help with these plans, too!

If you think you may qualify for the Medicare Savings Program or as a “Dual-Eligible” and want to apply, contact your state’s Medicaid program. You can find contact information for your state’s Medicaid program on the Medicaid website or by calling 1-800-MEDICARE (1-800-633-4227).

Additionally, some states may have programs that assist with Medicare costs, so it is worthwhile to check with your state’s Medicaid office.

If you need help or have questions about these programs or Medicare Advantage (Part C) plans designed with you in mind, please call (404) 996-0045.

How to Pay the Medicare Part B Premium

Paying the Medicare Part B premium can be done in several ways, depending on your situation.

1. Automatic Deductions

If you receive Social Security, Railroad Retirement Board (RRB), or Office of Personnel Management (OPM) benefits, your Medicare Part B premium will usually be automatically deducted from your monthly benefit payment.

2. Direct Payment Methods

If you don’t receive these benefits or automatic deductions aren’t an option, you can pay your Medicare Part B premium directly to Medicare. Here are the different ways to do this:

a. Medicare Easy Pay- Medicare Easy Pay is a free service that allows your premium to be automatically deducted from your bank account each month. Learn more and sign up here >> Medicare Easy Pay

b. Online Bill Payment Service- You can use your bank’s online bill payment service to set up recurring or one-time payments.

c. Pay Online via Medicare.gov- You can pay your premiums online through your secure MyMedicare.gov account.

d. Mail a Check or Money Order—To ensure proper processing, use the payment coupon included with your bill and mail your payment to the address provided on your bill.

Next Steps

For more information on your Medicare costs and Medicare plans available in your area, please call or text (404) 996-0045. You can also use the link below to schedule a phone call with Chad.