- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Health Savings Accounts- Time to brush up

January 11, 2016

Do I Need Medigap?

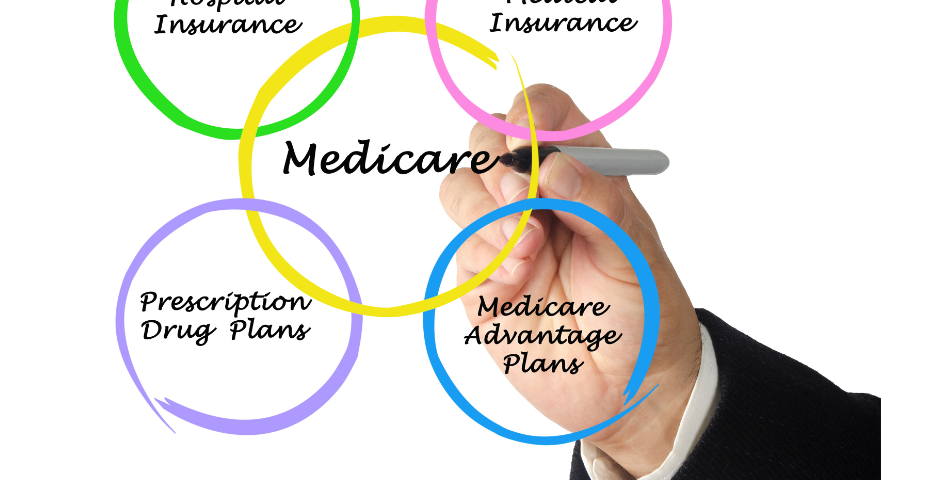

August 12, 2016Medicare Plan Choices

When it comes to your Medicare Plan choices, you have two ways of getting “supplemental” coverage. If you want more coverage than Medicare Part A (80% hospital) and Part B (80% medical), you can select a Medicare Supplement (Medigap) plan or a Medicare Advantage (Part C) plan.

Once you decide on the type of supplemental coverage you want, there will be many “Plans” to select from that many reputable insurance companies offer. So, even though there are only two “types” of Medicare plan choices, it can still be confusing. It’s not uncommon for seniors to need a helping hand through the process.

Fortunately, there are many resources available to do just this. From free resources to trained & licensed insurance professionals, there are many ways for seniors to find high-quality information about Medicare. Here are some tips for getting the help you need with your Medicare decisions.

Consult free resources

Medicare.gov’s annual “Medicare & You” handbook is a great place to start. This valuable, free PDF resource offers helpful information about programs, options, and what may be best for you. On that same note, the Medicare.gov website also provides a convenient “Plan Finder” feature that allows seniors to compare plans, drug plans, and supplemental policies according to their geographical location. This can be a helpful way to get state-specific information that will assist you in your Medicare purchasing decisions.

Talk to friends

If your friends have recently qualified for Medicare, they likely have some helpful information to offer. Look to them for tips on what to do and what to avoid. Listening to other people’s personal stories can go a long way toward helping you decide which Medicare plan is best for you. Be careful; what’s suitable for your family member or friend may not be right for you. For example, if you like the freedom to choose your doctor and hospital, you would want to go with a Medigap plan, also known as Medicare Supplement insurance. Before you decide, you need to know the difference between Medigap and Medicare Advantage.

Contact a professional

If you’re still having trouble navigating your Medicare plan choices after consulting the free resources available to you and talking with your social circle, consider enlisting the help of an insurance professional. I advise you to always speak with a licensed and qualified individual regarding your health care decisions.

One of the best ways to do this is to work with an independent Medicare insurance agent. Independent agents get compensated by the insurance company, so their service is also “free” to you, the consumer. You pay the same rate if you go directly to the company as you would when working with a qualified independent agent/agency who can shop many companies, plans, and rates simultaneously.

Independent insurance agents do a comprehensive walk-through of your Medicare eligibility with you, which translates into better information and care.

Another benefit of working with an independent insurance agent is that agents generally have up-to-date knowledge about what’s happening in the Medicare industry and can provide real-time information about your care, costs, and Medicare plan choices.

Conclusion

While navigating Medicare for the first time can be overwhelming, it doesn’t have to be. There are dozens of free, high-quality resources you can consult to get acquainted with the system, and if that doesn’t cut it, you can always contact an insurance agent, like me, to help you.

As a licensed independent insurance agent, I provide a free service by shopping and comparing your Medicare plan choices among the leading Medicare Supplemental insurers- to find you the best deal.

Medicare is necessary; you must get the information you need to make good decisions. To learn more about your Medicare plan choices or to speak with us further regarding our services, please call (888) 901-4870, or you can schedule a call with me here >> Speak with Chad