- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Medicare Supplement Questions?

December 8, 2023

Medicare Part B Premium

August 6, 2024Medicare Supplement Plan G: Why is it popular, and is it right for you?

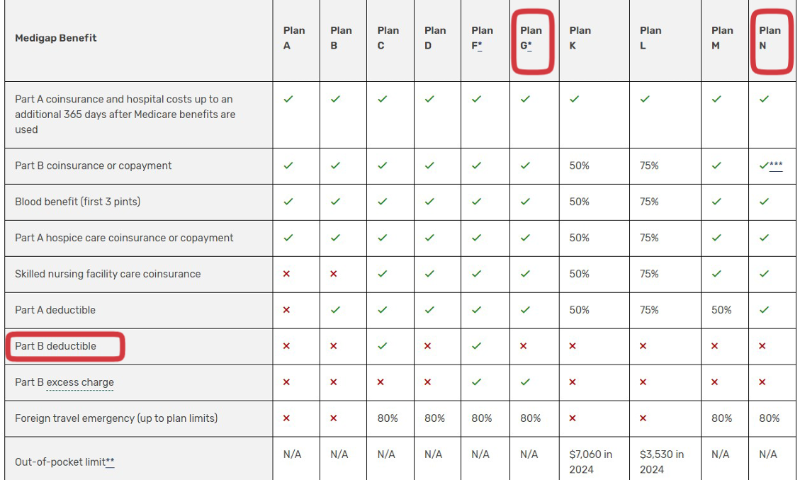

Medicare Supplement plans are also known as Medigap plans. So, Medicare Supplement Plan G is the same as Medigap Plan G, but with different terminology.

Of all the Medicare Supplement plans offered, Medicare Supplement Plan G is the fastest-growing.

Compared to other Medicare Supplement plans, Plan G had a 38% share of enrollments in 2023, a 21% increase since 2018, and Medicare Supplement growth goes beyond Plan G.

Between December 2017 and December 2021, the share of Original Medicare (those with Parts A and B, not enrolled in Medicare Advantage Part C) enrollees who purchased Medicare Supplement coverage increased from 35% to 41%.

The overall growth of Medicare Supplement consumers may not be surprising, but why the uptick in popularity for Plan G, specifically?

While there are several reasons a Medicare Supplement plan may be attractive to consumers in Medicare-eligible years, I would like to highlight four aspects of Plan G.

1. 100% Hospital and Doctor Coverage

When comparing any Medicare Supplement plan, also known as Medigap, to other Medicare plans, like Medicare Advantage “Part C,” one of the most significant value points is their coverage.

Medicare Supplement plans cover some or all out-of-pocket costs for Medicare-eligible hospital and doctor expenses, such as deductibles, coinsurance, and copayments.

Medicare Supplement Plan G is one of ten “standardized” Medicare Supplement plans you can select from, and it pays 100% of Medicare-eligible expenses after you’ve met the Part B calendar-year deductible ($240 in 2024).

In addition to paying your Medicare Part B monthly premium to Medicare, if you decide to purchase a Medicare Supplement plan, you’ll pay a premium to the insurance company you buy it from.

An independent insurance agent like myself can shop many reputable companies in your area to find you the right company and premium rate!

Plan G premiums may start low, but as with any plan, you’ll experience annual rate increases. Due to offering such robust coverage, Plan G rate increases can be some of the highest. We help our clients keep their premium rates as low as possible yearly. 🙂

2. No Networks

Medicare Supplement plans have no networks or referrals, meaning insured members can see any provider they know and trust if they accept Medicare. That’s a lot of options, considering that, as of 2023, only 1.1% of non-pediatric providers have formally opted out of Medicare (CMS data, as of 2023).

Combined with the coverage offered with Plan G, this flexibility may be a reason for the surge in popularity. It is an excellent option for those who are active and on the go, whether snowbirds or travel enthusiasts.

One of my goals when I retire is to travel and try new things, and I imagine many of my clients are hoping to do the same! Should they need medical coverage when hiking in Arizona, hitting the slopes in Montana, or enjoying a fast-paced game of pickleball in Florida, their Medicare Supplement Plan G coverage goes with them everywhere in the U.S.

Call (404) 996-0045 or schedule a quick call with me here >> Schedule your no-pressure Medicare call with Chad!

3. Predictable Costs

Unlike many Medicare Advantage Part C plans with a $0 premium, Medicare Supplement plans have a monthly premium. But there’s more to consider than the monthly premium rate.

As I mentioned earlier, Medicare Supplement insurance works with Original Medicare to help keep out-of-pocket costs to a minimum because premiums are potentially an expected, regular expense; Medicare Supplement plans may offer cost predictability for some.

My Medicare Supplement clients feel more in control, knowing when and how much they’ll pay for their medical care. This predictability rings true when considering Plan G, too.

On the surface, Medicare Supplement Plan G may look more expensive because premium rates can be higher than those of other Medicare Supplement plans. However, once the annual Part B deductible is met each year, there are no additional out-of-pocket costs for Medicare-eligible services nationwide.

4. Stability

Some Medicare plans (think Medicare Advantage Part C plans) can change from year to year, from network providers to benefits. With a Medicare Supplement plan, the plan benefits don’t change year to year, and because there are no networks, members don’t have to worry about changes and disruptions caused by their provider no longer being in the network.

Stability may be important to consumers looking at a Medicare Supplement plan. Enrolling in a Medicare Supplement Plan G or any Medicare Supplement plan early on, during your Medicare Supplement Open Enrollment Period, guarantees you’re locked into that coverage for life!

Once enrolled, you only need to pay your premiums when due, and that plan is yours forever! Plans are guaranteed renewable for life. The plan benefits won’t change, the plan cannot be canceled, and you don’t need to re-enroll each year- which may be the best thing of all.

With your coverage secured, you can relax and tune out the numerous ads and unsolicited phone calls you’ll experience throughout the year, especially around the Medicare Annual Enrollment Period (October 15th through December 7th).

Medicare Supplement Premium Rates

Premium rates for Medicare Supplement plans are determined by your residential address (the address listed on your taxes), among other factors. Medicare supplement policyholders span a broad range of incomes (CMS beneficiary survey, 2020).

Financial situations are unique, and medical coverage decisions are personal to every consumer. I believe those who appreciate the peace of mind of being able to best predict their total annual out-of-pocket costs may be driving the popularity of Plan G and other Medicare Supplement plans, like Plan N.

Next Steps

Let’s schedule a quick phone call, and I’ll show you Medicare Supplement Plan G (and any other plan) rates with many reputable insurance companies in your area.

CLICK Here >> Schedule a call with Chad!