- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Key Medicare Enrollment Periods

February 10, 2017

Which is best: Medigap Plan F or Medigap Plan G?

February 16, 2017Medigap Plans: What To Know Before You Buy

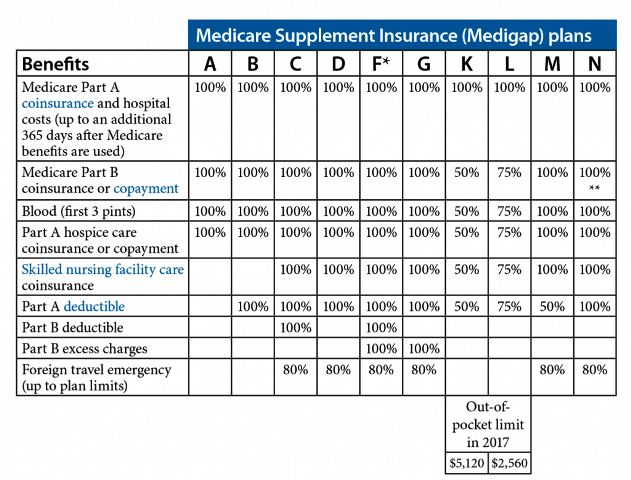

Medicare decisions can be tricky. Medicare itself is pretty simple, but it’s the options that help to pay the costs regular Medicare doesn’t cover is where it can get dicey. There is a lot of information to process, and once you make a decision, depending on what you selected, you could get stuck with that decision for quite a while. There are only 2 options when it comes to supplementing Medicare: Medicare Supplement Insurance (also known as Medigap plans), or Medicare Advantage plans (any plan that’s a Medicare Advantage plan is Part C).

So, that’s why it makes sense to consult with an experienced agent and make a careful decision right from the very beginning. And that’s what I’m here for!

So let’s start with the basics: What do you need to know before you sign up for any one of the Medigap plans available? Here are some of the basics:

- Medigap coverage is the same thing as Medicare supplement insurance. However, it is different from Medicare Advantage, or Medicare Part C.

- Both Medicare Advantage and Medigap are designed to provide you with help paying emergency medical bills not covered by basic Medicare Part A and Part B.

- The best time to buy a Medigap plan is during your Medigap open enrollment period, which lasts for six months beginning on the first day of the month in which you turn 65 or older and you are enrolled in Medicare Part B. As long as you buy during the open enrollment period, you cannot be turned down for coverage, nor can they charge you more because of your medical issues.

- If you fail to purchase a Medigap plan during our your open enrollment period, your carrier may force you to pay more for coverage, or even decline coverage altogether.

- Medigap plans are standardized. Every company’s Medigap plans have the same features and benefits. However, they aren’t all priced the same. Companies may have different prices for different plans, and many of them underwrite smokers and nonsmokers differently. Though two companies may sell identical plans, they can be priced very differently. I can help you choose from among the different plans available in your state.

- To enroll in a Medigap plan or Medicare Advantage plan, you must also be enrolled in both Medicare Part A and Part B.

- You must pay a monthly premium for both Medigap coverage and Medicare Advantage coverage. However, some advantage plans don’t have a premium per month and low income individuals may qualify for reduced premiums or other assistance, in some cases.

- Medigap plans rates are competitive. If you want to enroll in Medigap, you can choose any carrier licensed in your state. Provided you enroll during your Medigap open enrollment period, you cannot be turned down for coverage.

- All Medigap plans are guaranteed renewable. That is, as long as you are current with your premiums, your carrier cannot drop you from the plan at renewal time, regardless of your medical condition.

- Medigap plans don’t cover long-term care. Medicare Part A covers nursing home care but only under very limited circumstances. If you need nursing home care or adult day care, you must pay for it with a combination of your own savings, family resources and long term care insurance benefits.

- Medigap plans only cover a single person. There are no spousal benefits, except maybe a household discount, and it’s not a family plan.

- Medigap plans do not provide prescription drug coverage. If you want prescription drug coverage, you must purchase a Part D plan, or a Medicare Advantage plan that includes prescription drug coverage.

Those are twelve basic points about Medigap plans, as well as Medicare Advantage plans. As always, I’m happy to answer your questions and provide any insight. Additionally, my services are free to you, as I’m compensated entirely by the insurance carriers.

Are you turning 65 or enrolling into Medicare Part B for the first time? Don’t let your Medigap open enrollment period slip by! Call me today, at 888-901-4870, or fill out the information form by clicking here, and I will promptly follow up with you. I look forward to working with you!