- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Medicare Annual Enrollment: What You Need to Know This Year

October 20, 2015

Medicare and Other Insurance: How it Works

November 15, 2015Medigap Plans Comparison

When it comes to selecting a Medigap insurance plan, also known as Medicare Supplement insurance, it doesn’t have to be difficult. Medigap plans are offered by private insurance companies to cover health care costs that Original Medicare Part A (Hospital) and Part B (Medical) don’t cover. You should do a Medigap plans comparison, so that you know all of the plans available and how they pay with Original Medicare.

While Medigap policies do cover a great deal of benefits, they don’t cover prescription medication (Part D), long-term care, or routine dental and vision care.

With that in mind, it’s important to know what else Medigap insurance policies don’t cover. Performing a Medigap plans comparison will help you choose the right Medigap policy that fits your needs and budget.

Standardized Medigap Policies

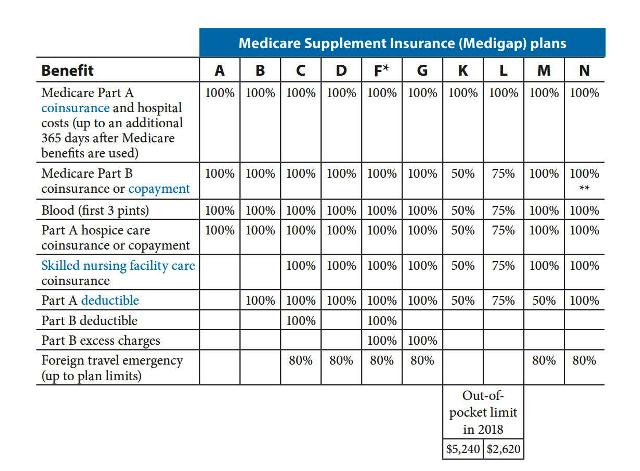

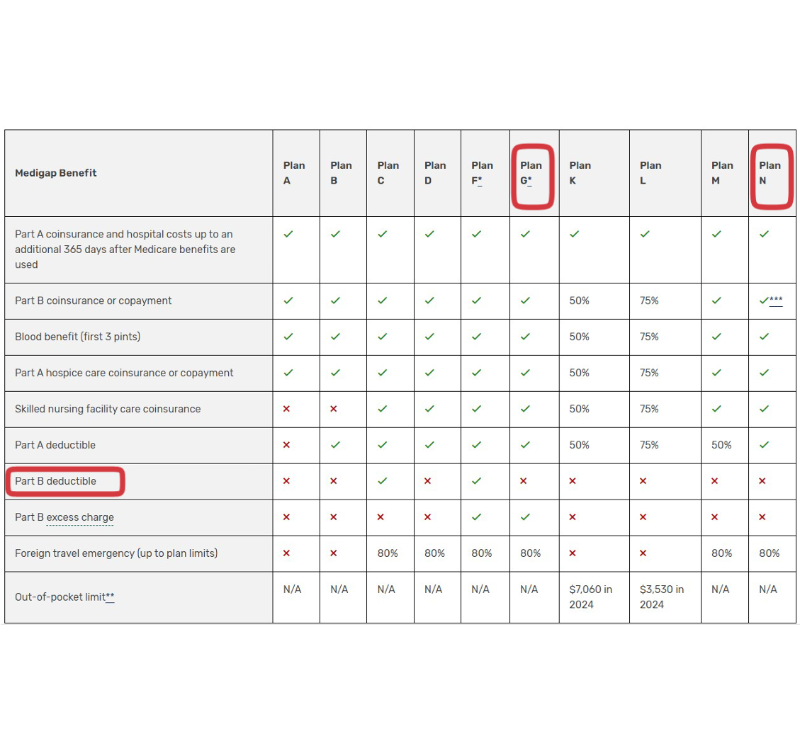

In order to protect consumers, Medigap insurance policies are all standardized and each is required to follow both state and federal laws. Additionally, Medigap policies must be clearly defined as “Medicare Supplement Insurance” and all private companies are required to sell only standardized policies, identified by letters A-N. Please see the chart below:

Despite this, each state’s Medigap policies offer the same base coverage benefits, but some states offer additional benefits in order to allow consumers to choose a plan that best covers their needs. Each state is in charge of which Medigap policies it sells and, as a general rule, private companies aren’t required to offer all Medigap plans. They can pick and choose which plans they want to offer, however, they’re required to offer Medigap Plan A with their Medigap policies. They are also generally required to offer Plan C or F alongside their other plans.

It is worth noting that residents who live in Massachusetts, Minnesota, or Wisconsin may have access to Medigap policies that are standardized differently. For more information on these plans, individuals can contact Lifelong Insurance, LLC.

Purchasing Medigap Policies

Most insurance experts agree that the best time to purchase a Medigap policy is during an individual’s 6-month Medigap open enrollment period. During this period, individuals interested in Medigap can purchase any policy offered by the state, regardless of whether pre-existing conditions are present. When an individual purchases Medigap coverage, the plan starts as soon as the individual turns 65 and is officially enrolled in a Medicare Part B plan. Individuals who don’t purchase Medigap coverage during open enrollment may have difficulty purchasing one or may need to pay more for coverage.

Moreover, during the Medigap open enrollment period, if you know you’re in poor health, you can take advantage of this period and purchase any Medigap policy offered by a company, in your state- regardless of health. Those who don’t purchase Medigap during one of these two times will need to apply for Medigap coverage after the open enrollment period, at which point it may be difficult to secure Medigap coverage.

With this in mind, it’s wise to ensure that you’ve researched Medigap coverage, have made a decision about a plan that will provide you with the benefits you need, and have planned your purchase to coincide with open enrollment periods. Doing this ensures great prices and a wide selection of plans.

What next?

Complement your Medicare coverage with a Medicare supplement insurance plan. Our agency is licensed and approved and in just one phone call, we can:

- Walk you through every standardized Medicare Supplement insurance plan and benefits (11 Standardized Medigap plans nationwide), with many reputable companies, such as Mutual of Omaha, Aetna, Cigna and more…

- Help you find the plan to fit your needs and budget

- Answer any questions you might have about Medicare and Medicare Supplement insurance coverage

- And if you’re ready to enroll, we can even sign you up over the phone, email or through the mail

To learn more about Medigap coverage or for assistance in choosing a plan, contact Lifelong Insurance, LLC today…. or call me directly at (888) 901-4870.