- Licensed & Approved Agency in Multiple States

- (888) 901-4870

- (404) 996-0045

Medicare and Your Health Savings Account

April 5, 2017

Plan F: The Most Popular Medigap/Medicare Supplement Plan F

May 12, 2017What’s Covered Under Medicare Part B?

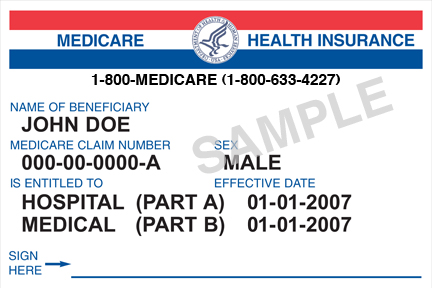

Most people know that Medicare Part A covers hospital charges – that is, your basic ‘bed-per-night’ fees, over and above your Medicare copays and deductibles, and that Medicare Part B generally covers physician’s charges. And, of course, you will be automatically enrolled in both if you’re already collecting Social Security. If you’re not, you will need to sign up for Medicare Part A and B.

Once you’re enrolled, and if you’re collecting Social Security benefits, then you will see your Medicare Part B premiums taken out of your Social Security check – $109 per month on average in 2017 (the official rate for individuals with incomes of $85,000 or less, or couples with joint incomes of $170,000 or less, is $134 per month). If you’re not collecting Social Security, you will pay Medicare directly for your Part B coverage.

But what benefits and protections do you get, exactly, for your money?

Generally, Medicare Part B covers services deemed to be medically necessary, and/or preventive services.

- Part B covers most physician charges – including the physician’s charges you incur while an inpatient in the hospital. Part B also covers physician’s fees if you get care on an outpatient basis, and even consultations and other services you get in the doctor’s office, even if there’s no hospital stay.

- Part B covers most forms of outpatient therapy, though beginning this year, there may be some limits on covered charges for physical therapy, speech and language pathology services and occupational therapy. But some exceptions apply even for these services so you can get covered beyond the generally applicable limitations.

- Ambulance services.

- Lab fees & radiology services, including blood tests, X-rays and other tests.

- Some home health care.

- Preventative services, including screenings, vaccinations, some physical exams.

- Mental health, including inpatient, outpatient and partial hospitalization.

- Transfusions after the first three pints of blood within a calendar year.

- Limited outpatient prescription drugs (if you want prescription drug coverage, consider enrolling in Medicare Part D or enrolling a Medicare Advantage program that covers prescription drugs).

- Durable medical equipment (DME). To qualify as DME, the equipment must be able to withstand repeated use, used for a medical reason in your home, not generally useful for people who aren’t sick or injured, and expected to last for three years or longer. Medicare Part B generally covers the following items:

- Wheelchairs

- Walkers

- Oxygen tanks

- Insulin pumps

- Blood sugar monitors

- Blood sugar (glucose) test strips

- Crutches

- Hospital beds

- Powered wheelchairs and other powered mobility devices

- Continued passive motion machines

- Nebulizers

- Patient lifts

- CPAP and other devices to treat sleep apnea

Part B will help pay your DME costs whether you rent the equipment or purchase it outright.

How to ensure you will be covered

First, keep your Part B in force, and don’t cancel your Part B. Otherwise you may have to pay a penalty to re-enroll.

Second, ensure your provider accepts Medicare. If your provider or doctor isn’t accepting Medicare, they won’t cover the claim.

Third, ensure your provider accepts assignment. That means that they authorize Medicare to pay them directly. If they do, expect to pay 20 percent of the costs out of pocket, unless you also have a Medicare Supplement plan which pays that 20% for you.

Fourth, find out if you are in a competitive bidding program area. If you have original Medicare (that is, you aren’t enrolled in Medicare Advantage), you have to get certain DME from a specific contracted supplier. To learn more about the competitive bidding program for durable medical equipment, click here.

Part B doesn’t pick up all DME, lab and physicians’ costs. You are responsible for the first $183 in covered charges. That’s your deductible – the amount you pay before Medicare Part B starts paying benefits. And even then, you’re still responsible for 20 percent of covered charges (at Medicare-approved rates) on top of your annual deductible, unless you also have a Medicare Supplement plan which pays that 20% for you.

Note that in order to enroll in a Medicare Advantage plan or a Medicare supplement insurance plan, you must be enrolled in both Medicare Part A and B.

About Lifelong Insurance

Lifelong Insurance is an independent, customer-service driven insurance agency specializing in Medicare and Medicare Supplement Insurance. Our offices are near Atlanta, Georgia, but we are licensed to work with individuals from coast-to-coast on their personal insurance needs – especially when it comes to Medicare planning and related types of coverage.

Want more information on your specific circumstance? Call me today, at 888-901-4870 for a free, no obligation consultation. Or visit the contact page and submit your info, so that I, Chad only, can call you. We look forward to working with you!